Fall Is Here…Who’s Buying A House?

Last week, I blogged about a new IRS scam out there. Since that time, there was a major development in combating the IRS scams. A call center in India was raided by police and 70 workers were arrested for involvement in IRS phone scams. Check out the Forbes article here : Dozens Arrested In IRS Phone Scam

Now, let us proceed with this week’s topic: Buying A House!

The leaves are falling, the temperature is dropping, and the weekends are full of football…fall is here. I’ve always thought, especially in Wisconsin, that fall is one of the best time to buy a house. Locally, you want to get everything moved in/out before there is snow and ice on the ground. In fact, I moved into my house almost 2 years to the date. I did some research, and fall is indeed the best time to buy a home. October is the best month, and October 8th is the best date. (h/t Business Insider) Perfect timing for this blog post!

With all that being said, there are tax factors involved with buying a house.

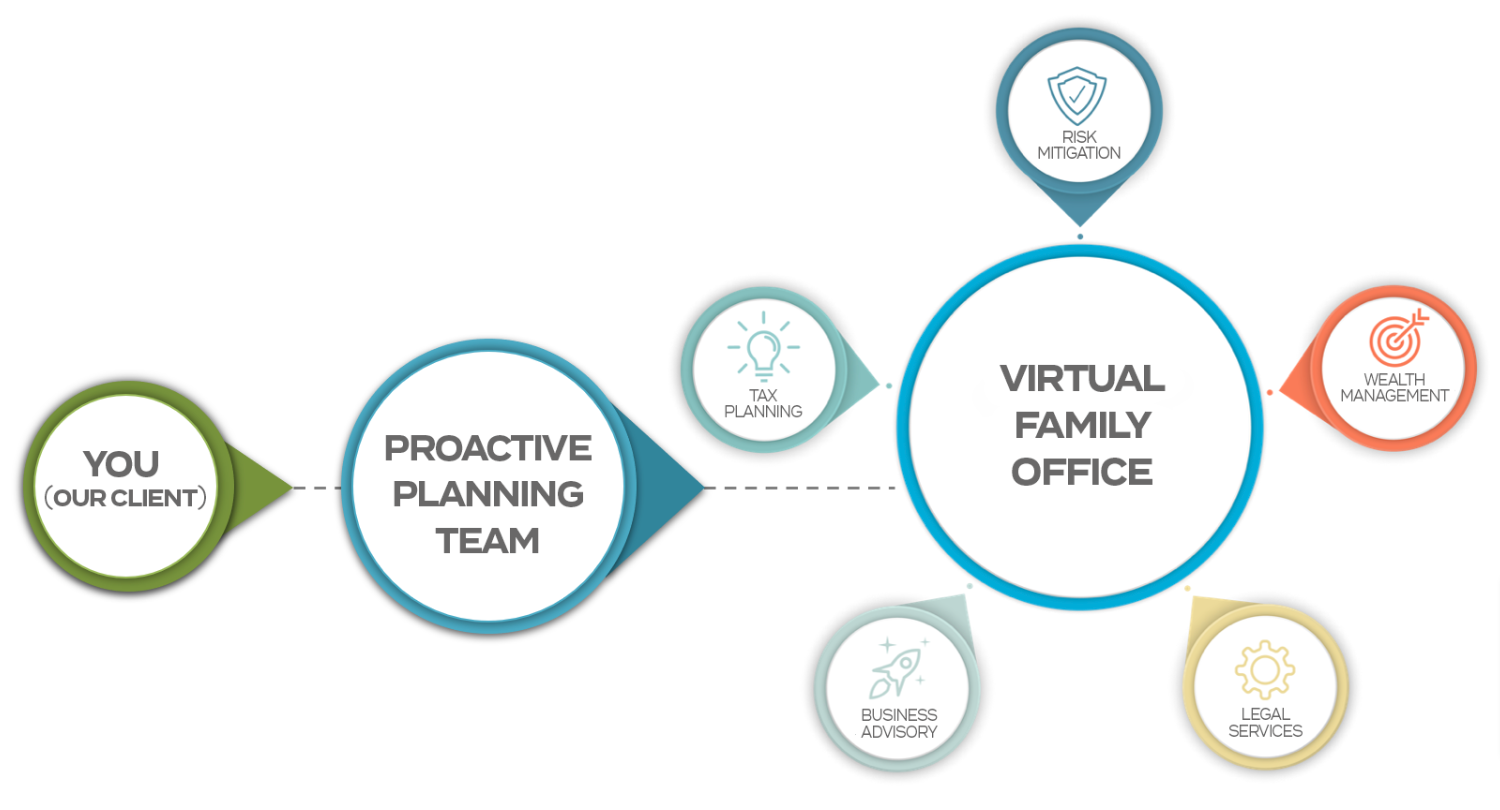

If you are a first time homeowner, welcome to the life of itemized deductions. If you are not new to being a homeowner, you are probably been in a relationship with itemized deductions for awhile. The interest that you pay for on your mortgage and the real estate taxes that you pay on your house are two main components of your itemized deductions.

Tax Strategy To Maximize Deductions

When you close on your house, there is a lot of paperwork involved(and signatures). The closing statement is a very important component of the sale. It shows all of the expenses involved with the sale. In most cases, it will designate the real estate taxes to the buyer and the seller based on the time of the sale. For instance, if the house is sold 10/1/16, 75% of the 2016 real estate taxes will be allocated as an expense to the seller, and 25% to the buyer. When you go to pay your real estate taxes, you will be paying the full 2016 amount. However, keep in mind that you have already been reimbursed for the months you did not live there on your closing statement.

Wait until January 2017 to pay the real estate taxes. This is very important to remember. Often times mortgage companies will automatically pay your current year real estate taxes on 12/31 of that year. This tax strategy will not be able to be implemented if this happens. We have already implemented this tax strategy with clients this year. If you or someone you know bought a house this year, please have them call one of our consultants so that we can help them save hundreds of dollars in taxes . This is just one tax planning strategy that we use to help Milwaukee, Waukesha, Brookfield, New Berlin, Wauwatosa with tax preparation.

P.S. Now that you have a new home, make sure you’ll stay there for awhile. When I say awhile I mean 2 years…that is the amount of time you need to spend in a principal residence to have the sale of your home excluded from being taxed.

Enjoy this fall weather this weekend!

Nicholas Hammernik, EA

The post Fall Is Here…Who’s Buying A House? appeared first on Talking Tax to Milwaukee.

See More Blog Posts