Build Your Own Business

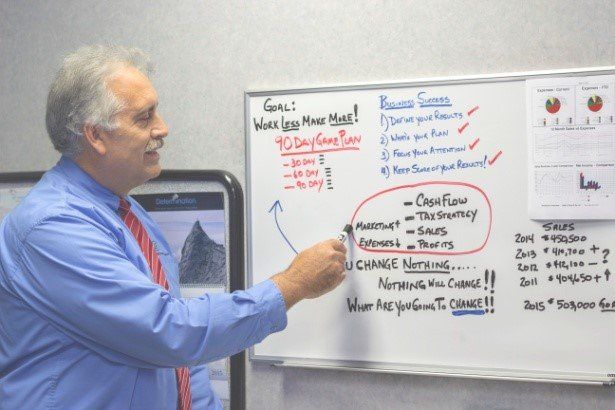

With our help, you will identify and avoid the common mistakes many new business owners make. We will help you build a business plan for success, as well as provide financial management services to meet your needs.

We have small business coaching available too. This can help you leverage your time and maximize your efforts with the limited time all business owners have.

Starting A Small Business In Wisconsin

Thinking of starting your own small business? There's a lot to think about and even more to get started. Don't get overwhelmed, call Hammernik & Associates to guide you. We are the small business partners everyone wish they had when they started. Our expert team has helped dozens of businesses throughout Wisconsin start and prosper. Let us guide you through the paperwork, startup concepts, and strategies needed to be a successful company and not another statistic.

Steps To Start Your Business

- Prepare a business plan and determine your initial capital needs.

- Identify your current resources, as well as sources of start-up capital and your borrowing capacity.

- Review potential business structures in terms of tax advantages and portability in case you need to relocate.

- Plan for financial management of your business by selecting accounting software that fits your projected budget and gaining the hardware necessary to run it.

- Understand the key components of a Cash Flow Projection and develop one to cover each month of your business for the first year, at least.

- Learn about the best billing and collection procedures to maximize your cash flow.

- Research and gain an understanding of employment laws so that you are prepared to comply from the start.

- Consider a home office for maximizing tax deductions.

- Prepare and file for all local and state licenses and permits.

- Gain a Federal Employer Identification Number and set up payroll services and payroll tax filing systems with your first employee.

- Identify any business insurance needs.

- Develop a Partnership Agreement. By putting the terms of all business partnerships into writing, you will save a lot of future pain and headache, as well as the potential detriment of your business.

Don’t let this list overwhelm your desire to start a business. Our services were created with small business owners like you in mind.

Tax Choices For Startup Businesses

Choosing which entity to operate your business involves two fundamental choices:

- Will you remain personally liable for business debts?

- How will you and your business pay tax?

There is no perfect answer, and every business is different. In many cases, you’ll want more than one entity. Please refer to our E-Book for more in-depth information.

"Straight Talk About Small Business Success In Wisconsin"

Authored by Dale Hammernik

Dale has written the growth map guide to helping Wisconsin businesses grow. It features specific chapters which focus on record keeping, financial statements, and cash flow.

Schedule a consultation with Dale to see how our bookkeeping and payroll services will allow you to have more freedom in your business.

“Dale Hammernik’s “Straight Talk About Small Business Success In Wisconsin” has everything an entrepreneur needs, from what type of legal structure is best to financial statements. It’s chock full of great info and case studies to help people understand how to get their business off the ground. When I started my own firm, I found Dale’s advice and depth of experience to be invaluable.”

- Review by Sue Pierman of Pierman Communications LLC

Get In Touch With Us

Fill out your information and we'll reach out.

CONTACT

Telephone: (414) 545-1890

E-mail: info@hammernikassoc.com

LOCATION

10777 Beloit Rd.

Greenfield, WI 53228